Structured for regulatory, investor, and operational

audiences

Section 1: ESG Fundamentals

Q1. What is ESG reporting, and why is it important for

enterprises?

ESG reporting discloses an organization’s environmental, social, and governance

performance. It’s essential for managing risks, meeting investor expectations,

complying with regulations, and enhancing long-term enterprise value.

Q2. How does ESG reporting differ from traditional CSR?

CSR is often voluntary and qualitative. ESG reporting is data-driven,

measurable, and increasingly required by regulators and investors. It’s

integrated into enterprise governance, strategy, and risk frameworks.

Q3. What frameworks does IVIS support for ESG reporting?

IVIS supports all major ESG frameworks including GRI, TCFD, SASB, ISSB, CSRD,

EU Taxonomy, and sector-specific standards. We map these to your enterprise

operations for compliance and comparability.

Section 2: Implementation & Systems Integration

Q4. Can ESG reporting be integrated into our existing ERP

and IT systems?

Yes. IVIS specializes in embedding ESG data pipelines into platforms like SAP,

Odoo, Oracle, and cloud-based BI tools. This enables real-time data collection,

control, and automated reporting.

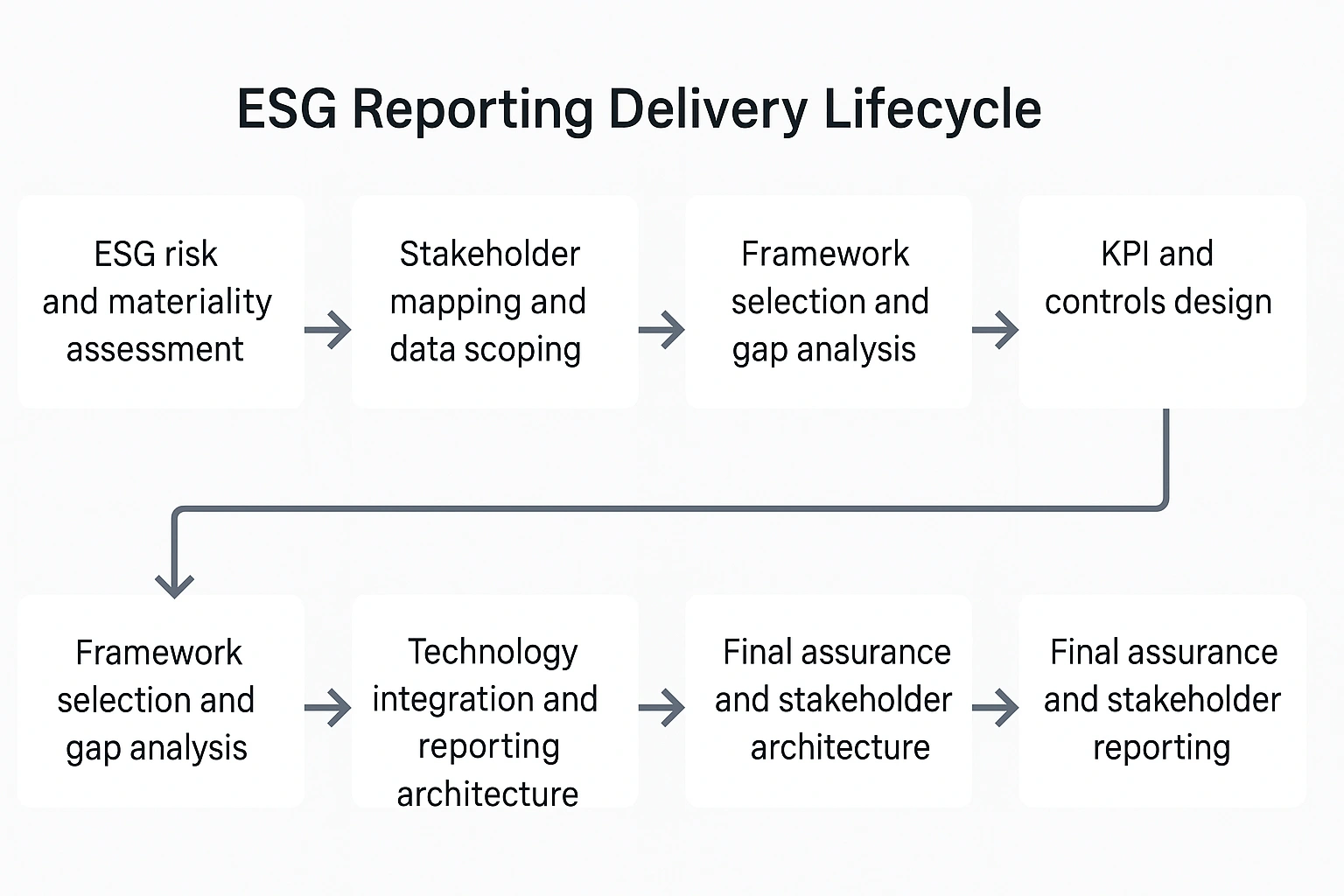

Q5. How long does a typical ESG reporting system take to

implement?

Implementation timelines vary by scope and system maturity. A modular ESG

reporting structure can go live in 8–16 weeks, with phased expansion for

assurance, stakeholder reporting, and dashboarding.

Q6. What types of ESG KPIs can be tracked through IVIS

dashboards?

We track environment (emissions, energy, water), social (diversity, safety,

labor practices), and governance (board structure, compliance, anti-corruption)

KPIs — all benchmarked and aligned to your sector and regulatory frameworks.

Section 3: Regulatory & Audit Readiness

Q7. Are IVIS ESG reports suitable for regulatory

compliance and investor filings?

Yes. Our reporting templates and disclosures are structured for audit trails,

assurance reviews, and capital market use. We ensure compatibility with CSRD,

SEC, SFDR, and IPO due diligence.

Q8. Do you assist with ESG assurance and third-party

validation?

Yes. IVIS supports both internal readiness and coordination with third-party

auditors for ESG assurance — including data integrity reviews, methodology

documentation, and framework alignment validation.

Q9. What happens if regulatory frameworks change after we

deploy?

Our ESG systems are modular and version-controlled. We update compliance

modules regularly and provide roadmap support to align with evolving standards

(e.g., from voluntary GRI to mandatory CSRD).

Section 4: Strategic Impact

Q10. How can ESG reporting create business value beyond

compliance?

ESG reporting supports better risk management, enhances reputation, improves

investor ratings, and unlocks access to sustainability-linked financing. It

also drives internal performance by aligning KPIs with long-term enterprise

goals.

Q11. Can ESG reporting support M&A, IPO, or private

equity processes?

Absolutely. IVIS provides ESG maturity assessments, pre-deal documentation, and

post-deal integration frameworks to enhance due diligence, valuation, and

stakeholder confidence during corporate transactions.

Q12. What industries does IVIS serve with ESG reporting?

We serve finance, energy, manufacturing, logistics, infrastructure, technology,

healthcare, and government sectors — each with tailored ESG models and

compliance structures.